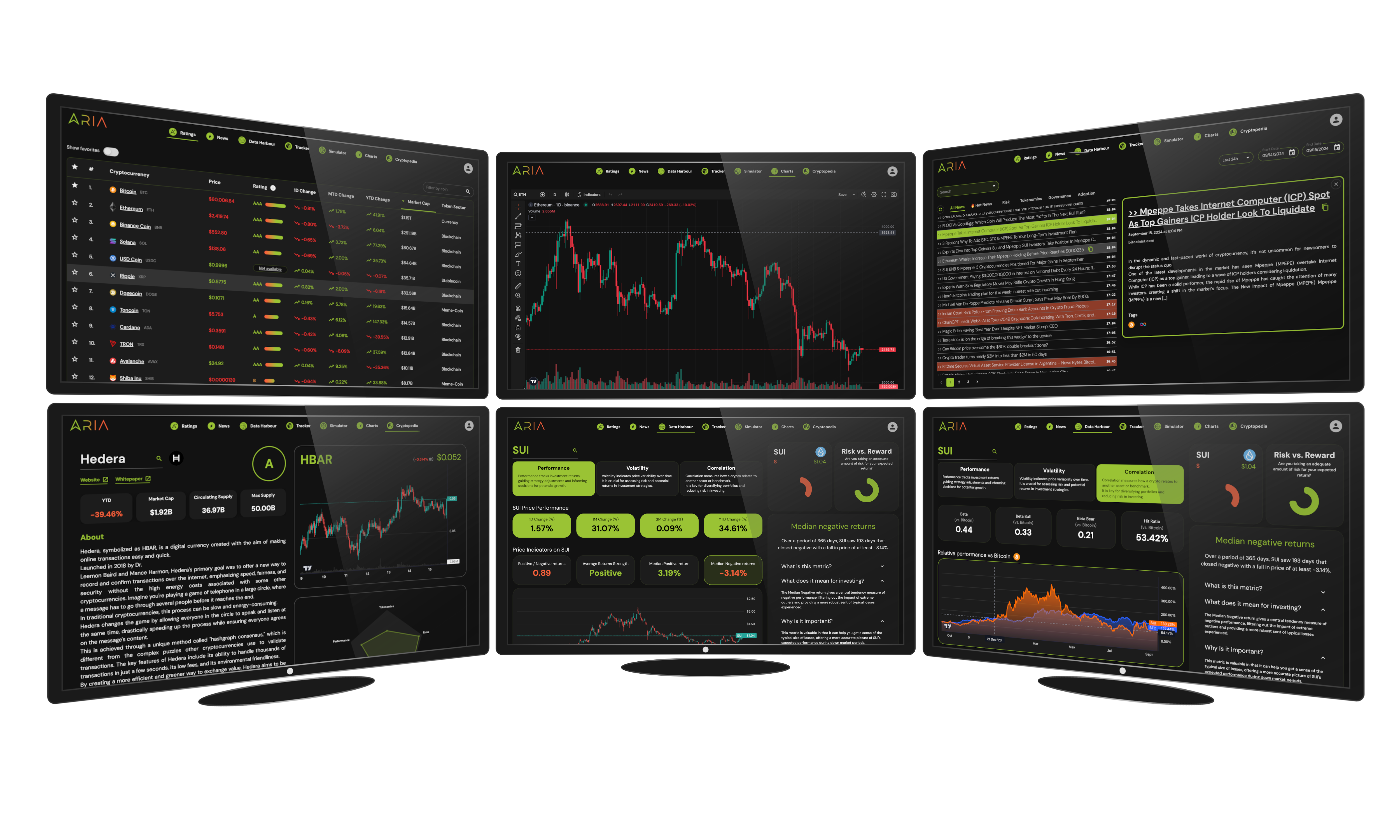

Our proprietary algorithm evaluates fundamental, governance, market, and risk factors to score each token, delivering a clear pass/fail view for compliance committees and powering the Listing Compliance Engine.

Learn More...

Turn fragmented crypto data into a regulator-ready view of each token

Automate regulatory and AML due diligence checklists

Maintain an immutable audit trail for every token decision

The same ratings that power our Listing Compliance Engine also drive transparent, compliant indexes for asset managers and ETF issuers.

Example: The Crypto AAA Index, composed exclusively of tokens rated AAA by ARIA—ideal for ETFs, structured products, and institutional portfolios.

• Pioneering risk-focused crypto indexing

• Transparent, governance-backed methodology

• Tailored solutions for institutional products

Exchanges today face stricter rules from regulators like MiCA in Europe and VARA in Dubai. Every token they list must be checked, documented, and monitored — or they risk fines and reputational damage.

ARIA makes this simple:

• Compliance Factsheets: Instant, regulator-ready reports for any token

• API Integration: Automates pre-listing checks directly in your platform

• Terminal: Continuous monitoring with alerts when risks or disclosures change

With ARIA, exchanges save months of manual work, stay regulator-ready, and keep their listings safe

The ARIA Terminal is the command center for compliance and risk teams — bringing together ratings, compliance factsheets, governance alerts, and audit-ready documentation.

If a regulator calls tomorrow, your answers are already here.

*Charts by TradingView

Get Institutional Access

>> SEC Moves to Regulate Uniswap: Bitwise Files for ETF Amidst Increased Scrutiny

15 hours ago>> Brazil Implements New Legislation to Ban Ethena's USDe Amidst Algorithmic Stablecoin Conce...

15 hours ago>> Bitcoin's Decline: VanEck Analyst Highlights Market Dynamics Behind the Drop

15 hours ago>> Bitcoin Faces Historic Decline as Investors Turn to Traditional Safe Havens: Bloomberg Ana...

19 hours ago>> Legal Developments Could Reshape the Landscape of Bitcoin Investments

20 hours ago>> Brazil Embraces Innovation with Groundbreaking Solana ETF Amid Possible Crypto Restriction...

20 hours ago>> Brazil Tightens Regulations, Sparks Bitcoin Innovation with $HYPER

a day ago>> South Korean Regulator Launches Investigation into ZkSync Amidst Price Volatility

a day ago>> Russia's Bitcoin Revolution: How the Country is Embracing Cryptocurrency Amidst Sanctions

a day ago>> UAE Investments Spark Concerns: Congress Investigates Crypto Links