Our proprietary algorithm evaluates fundamental, governance, market, and risk factors to score each token, delivering a clear pass/fail view for compliance committees and powering the Listing Compliance Engine.

Learn More...

Turn fragmented crypto data into a regulator-ready view of each token

Automate regulatory and AML due diligence checklists

Maintain an immutable audit trail for every token decision

The same ratings that power our Listing Compliance Engine also drive transparent, compliant indexes for asset managers and ETF issuers.

Example: The Crypto AAA Index, composed exclusively of tokens rated AAA by ARIA—ideal for ETFs, structured products, and institutional portfolios.

• Pioneering risk-focused crypto indexing

• Transparent, governance-backed methodology

• Tailored solutions for institutional products

Exchanges today face stricter rules from regulators like MiCA in Europe and VARA in Dubai. Every token they list must be checked, documented, and monitored — or they risk fines and reputational damage.

ARIA makes this simple:

• Compliance Factsheets: Instant, regulator-ready reports for any token

• API Integration: Automates pre-listing checks directly in your platform

• Terminal: Continuous monitoring with alerts when risks or disclosures change

With ARIA, exchanges save months of manual work, stay regulator-ready, and keep their listings safe

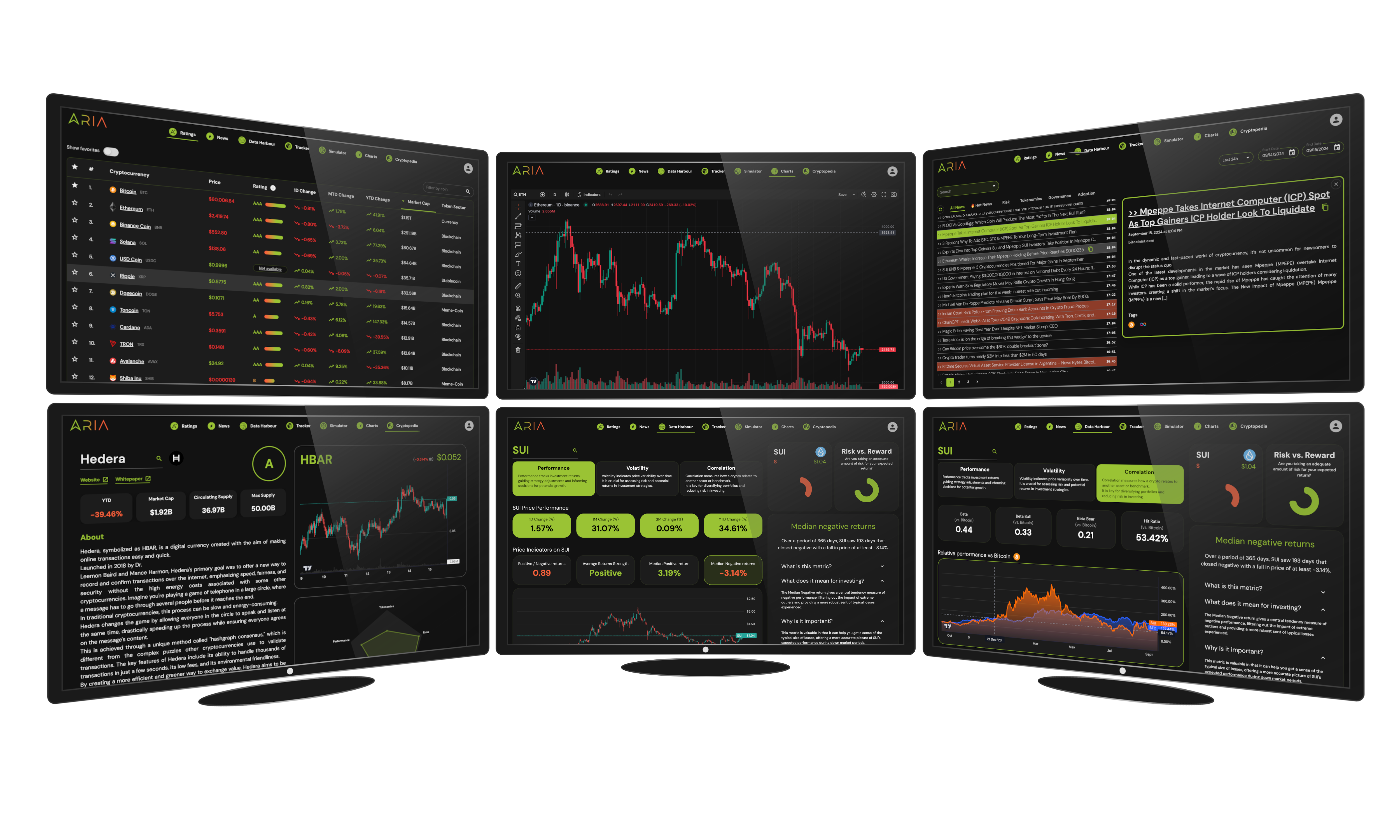

The ARIA Terminal is the command center for compliance and risk teams — bringing together ratings, compliance factsheets, governance alerts, and audit-ready documentation.

If a regulator calls tomorrow, your answers are already here.

*Charts by TradingView

Get Institutional Access

>> CFTC and SEC Unite for Comprehensive Crypto Oversight: A New Era for Ripple and Beyond

2 hours ago>> US Institutional Investors Strengthen Bitcoin Positions as Cosmos Health Makes a Bold Leap

4 hours ago>> US Court Victory for Binance: Can Regulatory Concerns Be Alleviated?

5 hours ago>> Judge Urged to Deny FTX Founder Bankman-Fried's New Trial Request

5 hours ago>> Crypto Advancements Revolutionize Trading Landscape in India

6 hours ago>> Grayscale Unveils Avalanche Staking ETF on Nasdaq, Boosting Institutional Interest

6 hours ago>> BlackRock Launches Innovative Staked Ether ETF Amid Growing Crypto Yields

8 hours ago>> Bitcoin Miners Reshape Their Future as AI Demand Surges, Says VanEck

11 hours ago>> Crypto Collaboration: Ripple and Mastercard Join Forces for Payment Innovation

15 hours ago>> Japan's Growing Interest in Stablecoin: Metaplanet Ventures into JPYC