Each index is built from tokens vetted through our proprietary rating methodology — the same ratings exchanges, brokers, and tokenization platforms use to meet regulatory due diligence standards under MiCA, VARA, and other frameworks.

The result: transparent, defensible, and compliance-friendly benchmarks for a regulated digital asset market.

Create regulated investment products with objective, risk-based selection criteria

Measure portfolio performance against a universe of high-quality, risk-screened assets

Offer investors safer, compliance-aligned alternatives to standard crypto indices

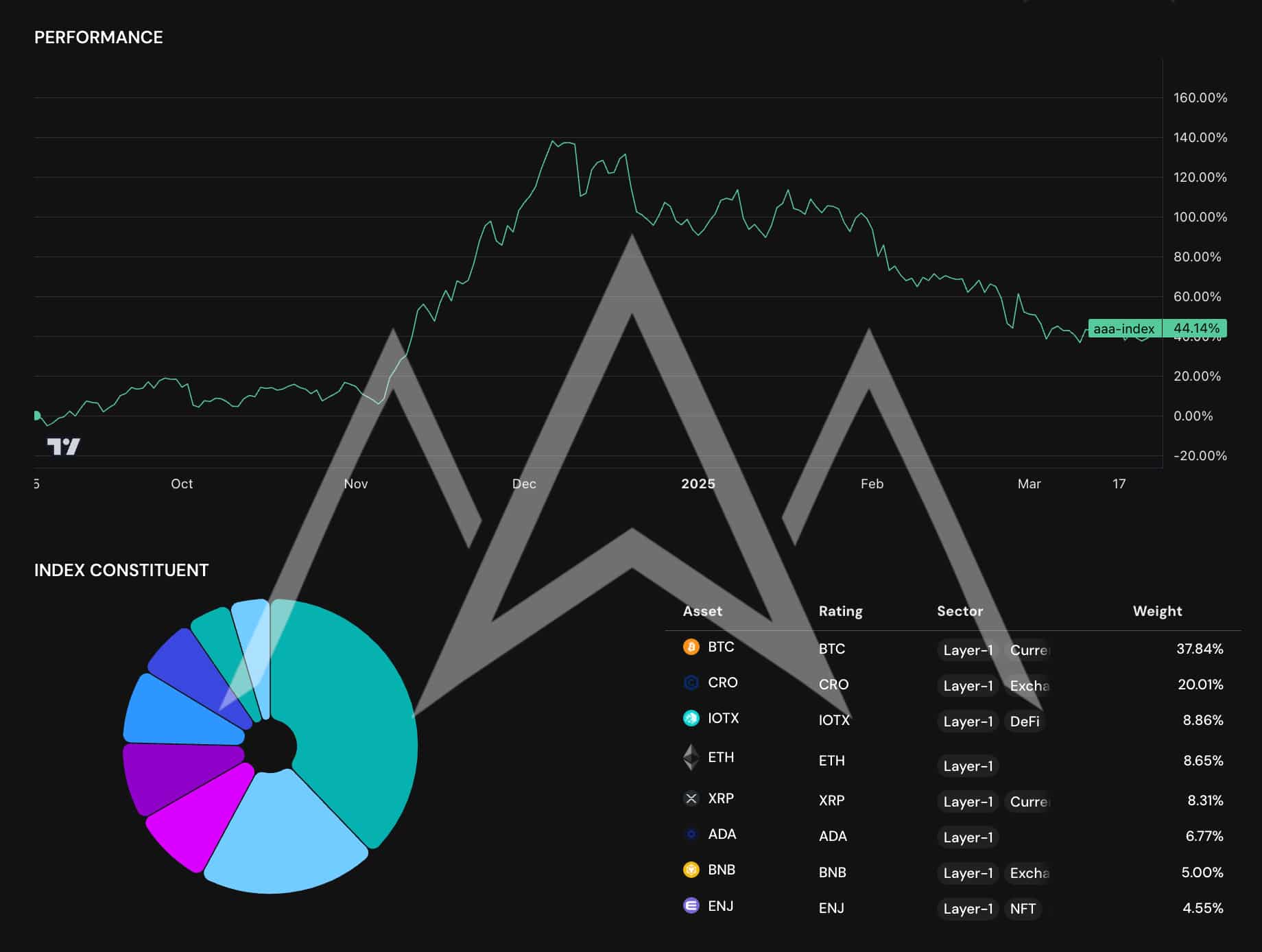

Tracks all tokens rated AAA by ARIA. Since launch, the index has consistently outperformed market-cap benchmarks like BTC or BTC/ETH blends — with lower drawdowns and stronger fundamentals. Designed for regulated environments, the Crypto AAA Index provides a safer, transparent alternative to traditional crypto exposure.