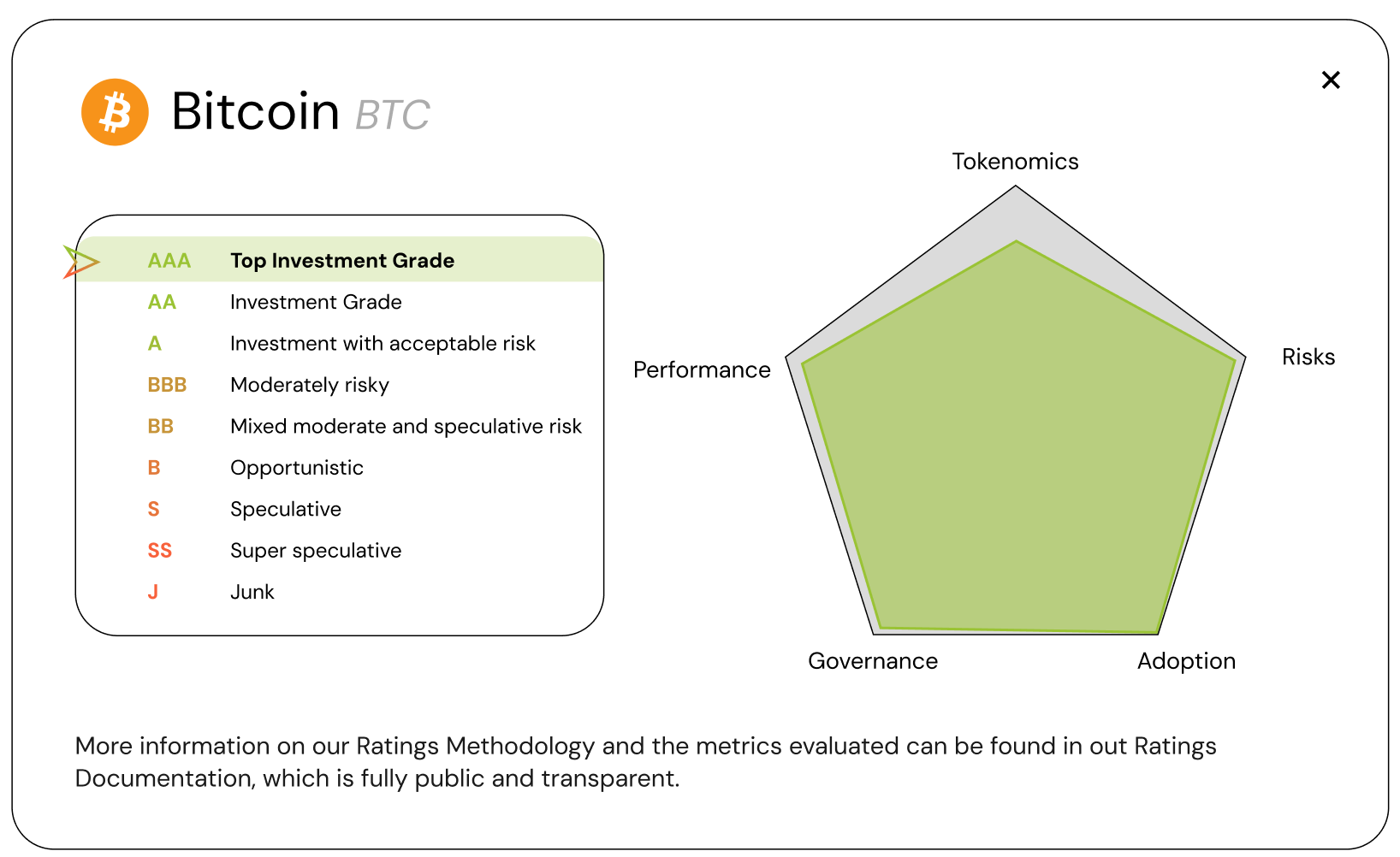

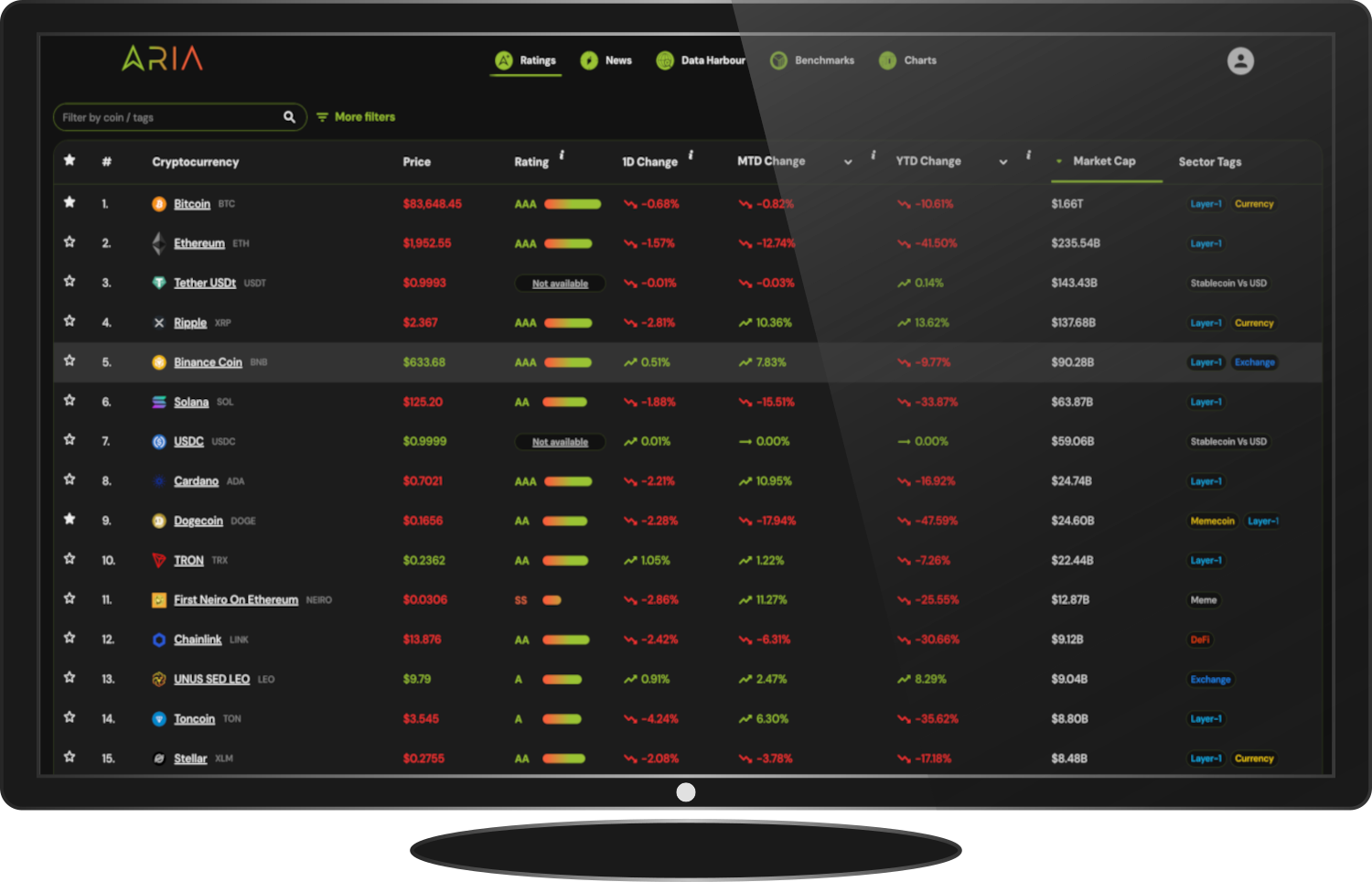

Using a proprietary quantitative algorithm, ARIA evaluates digital assets across 35+ risk metrics—including financial health, tokenomics, governance, and security. Our institutional-grade ratings deliver near-real-time risk intelligence, enabling confident, compliant, and defensible investment decisions.

• 35+ transparent risk factors

• Clear ratings from AAA (Investment-Grade) to J (Junk)

• Automated, unbiased assessment

• Flexible delivery via API, integration, or institutional terminal

Streamline token selection with objective risk filtering

Standardize due diligence across teams

Empower smarter allocation decisions with defensible data

Automate listing/delisting decisions using ratings thresholds

Surface per-token risk profiles to clients quickly

Strengthen regulatory documentation via audit-ready ratings data

Use ratings as one input in digital asset classification or sandbox criteria

Integrate real-world scoring into policy frameworks

Gain objective visibility into market risk concentrations