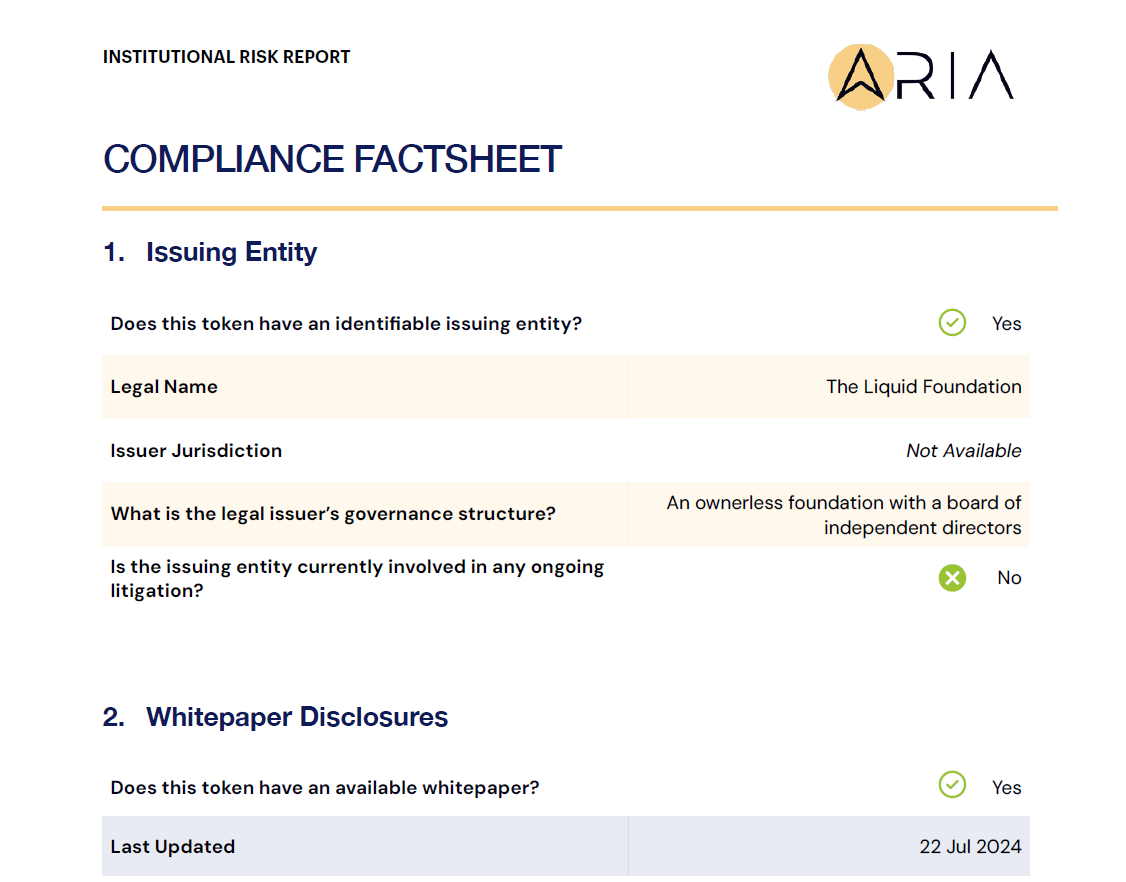

ARIA's Listing Compliance Engine gives exchanges, brokers, and tokenization platforms a complete, automated workflow for pre-listing due diligence and ongoing compliance monitoring. Every token gets a regulator-ready factsheet, powered by our institutional-grade risk ratings and governance checks.

Instantly screen any token against regulatory, governance, market, and AML criteria before approval

Get automated alerts when a listed token's compliance status changes (e.g., governance risk, liquidity drop, sanction flags)

Keep a complete, immutable trail of every listing decision for internal compliance and regulator requests

The ARIA Listing Compliance Engine consolidates multiple data sources like market data, tokenomics, governance, whitepaper disclosures, blockchain analytics, and AML/CFT screening, into a single, automated decision layer.

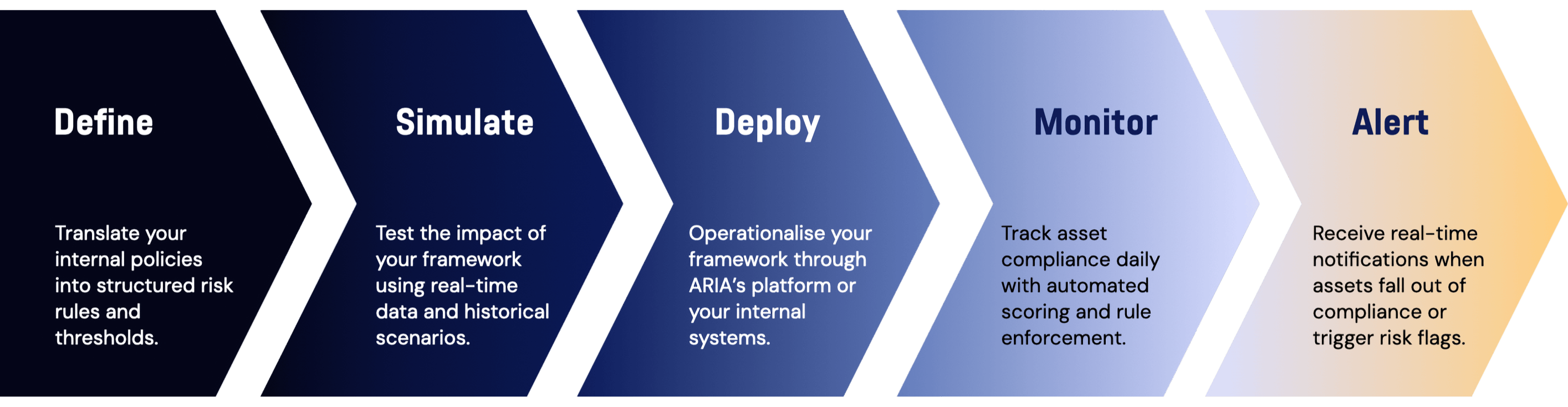

Tokens move through Pre-Listing Vetting → Continuous Monitoring → Audit Documentation, ensuring compliance from day one and every day after.