by aria-crypto.com

April 21, 2025 at 17:13

SEC’s Ongoing Pursuit of Crypto Companies Raises Concerns Among Industry Leaders

The SEC's scrutiny of the crypto industry continues to intensify, with Miami-based Unicoin currently under threat of legal action.

Unicoin’s co-founder, Alex Konanykhin, has stated that the firm will fight the SEC’s allegations in court rather than seek a settlement.

He asserts that Unicoin's compliance efforts have been substantial, reporting financial information to the SEC for over three years, despite the agency's claims of violations.

In a shifting regulatory landscape with a new Republican leadership, the SEC has recently eased enforcement actions against several crypto firms while continuing its pursuit of Unicoin.

The accusations against Unicoin include fraud claims and failure to verify airdrop eligibility for its native token, UNIC.

Konanykhin insists that the motivations behind the SEC's actions stem from a faction still loyal to the previous leadership rather than the new administration's policy direction.

In a related development, the venture capital firm Paradigm has urged the SEC to adopt a cautious approach regarding regulations on Maximal Extractable Value (MEV) in crypto markets.

Paradigm warns that overly aggressive regulatory actions could disrupt a market that is still evolving and finding solutions on its own.

They advocate for flexibility in regulation to protect investor interests while promoting innovation in the dynamic crypto ecosystem.

As the SEC grapples with its regulatory approach, the reactions from firms like Unicoin and Paradigm could shape the future of crypto policy in the U.S.

Grayscale Investments has taken a significant step by filing a Form S-1 registration statement with the SEC to convert its Bittensor Trust into a spot ETF under the ticker symbol GTAO. This move aims to provid...

In a striking report, over $110 billion in cryptocurrency was shifted from South Korea to foreign exchanges in 2025 due to stringent regulatory policies. This exodus underscores a significant regulatory gap, a...

As the US crypto industry enters 2026, a clearer regulatory framework is emerging after years of uncertainty. Leadership changes in Washington have created a more supportive environment for cryptocurrency, wit...

Bloomberg analyst Mike McGlone recently provided a cautious outlook on both silver and Bitcoin, highlighting potential risks as we look toward 2026. McGlone analyzed the current prices, indicating that silver ...

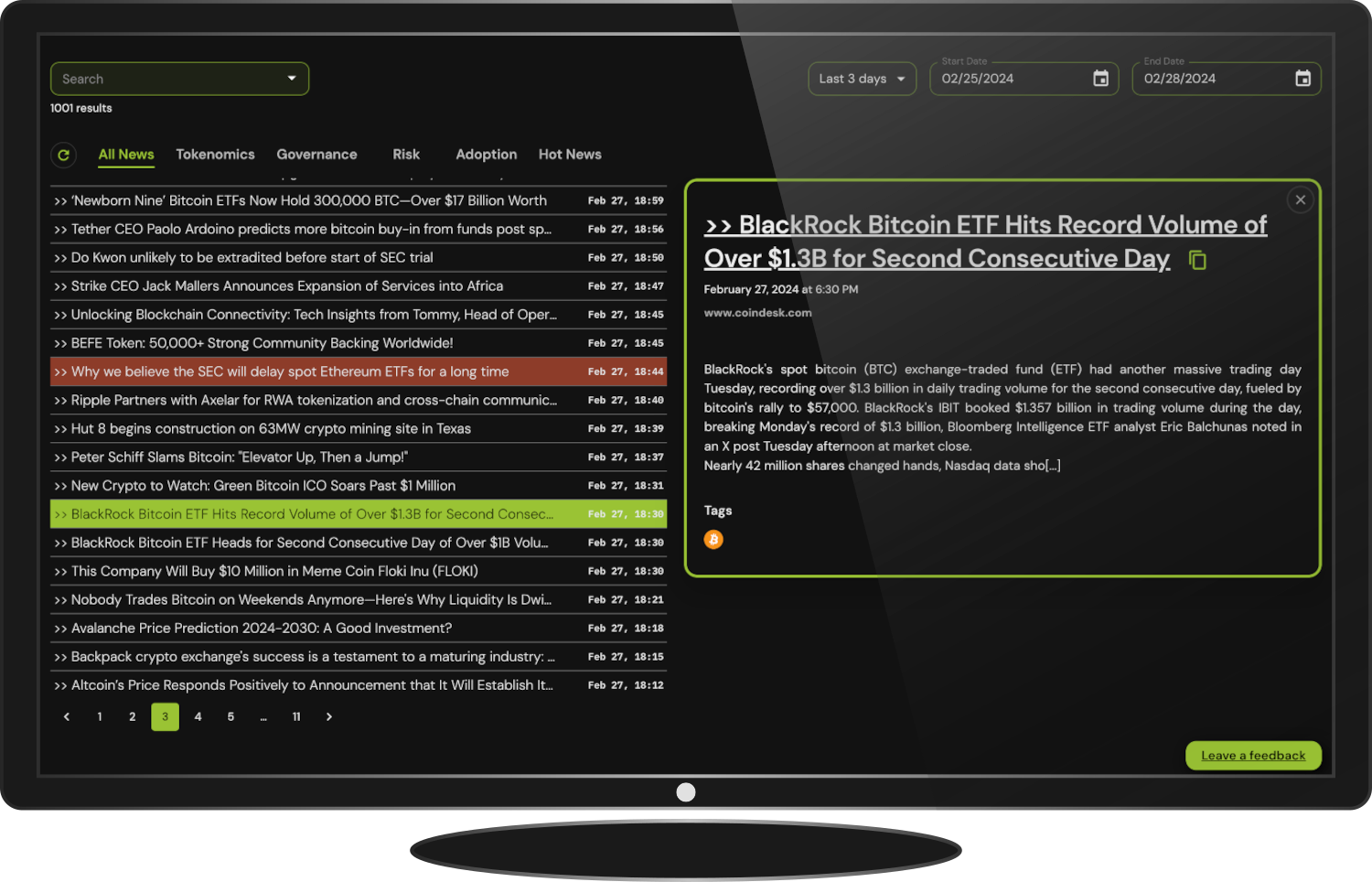

Stay informed and up-to-date on the market's latest news with ARIA's Institutional Terminal's News Aggregator.

Find your curated news articles and analysis from over 50 sources, including the crypto's biggest publications.

Get Institutional Access

17 hours ago