by aria-crypto.com

April 22, 2025 at 13:52

South Korea's Bithumb Restructures for Bitcoin-Centric Future as IPO Approaches

Bithumb, one of South Korea's largest cryptocurrency exchanges, is set to restructure ahead of its planned initial public offering (IPO) in 2025.

The company plans to spin off its non-core units into a new entity, Bithumb A, handling investments and other ventures, while the main Bithumb will focus on its core exchange operations.

This strategic move aims to enhance operational efficiency and effectively isolate risks tied to non-exchange activities.

Despite being the second-largest exchange in South Korea, Bithumb reported a net profit of $110 million in 2024, reflecting significant growth despite stiff competition from Upbit.

Analysts believe this restructuring will present a clearer corporate structure to potential investors, thereby enticing a more favorable response during the IPO process.

Samsung Securities has already been appointed as the lead underwriter for this pivotal listing, which may target both KOSDAQ in South Korea and potentially the Nasdaq in the United States.

Coincidingly, Bitcoin's dominance in the crypto market has surged to around 64.6%, highlighting a broad investor shift towards perceived safe assets amid macroeconomic uncertainties.

Bithumb's focus on Bitcoin operations aligns with its efforts to attract investment during this pivotal moment in the crypto landscape.

As potential regulatory scrutiny looms, company officials are optimistic that their strategic adjustments will pave the way for growth.

All eyes are now on how Bithumb's restructuring will impact its operational and market dynamics as the company prepares for a significant IPO.

The U.S. Securities and Exchange Commission (SEC) has initiated a crucial lawsuit against multiple alleged fraudulent crypto investment clubs and trading platforms that reportedly defrauded investors of over $1...

VanEck has issued a measured outlook for Bitcoin leading into 2026, emphasizing a year of consolidation rather than explosive growth or dramatic declines. In a recent analysis, portfolio manager Matthew Sigel ...

In a significant move, Bybit, the world's second-largest cryptocurrency exchange, has announced plans to withdraw its services for Japanese residents starting in 2026. This decision comes amidst increasing scr...

Russia's central bank has revealed a significant framework intended to regulate cryptocurrency trading by July 1, 2026, reflecting a notable shift towards a more accommodating stance on digital assets. This pr...

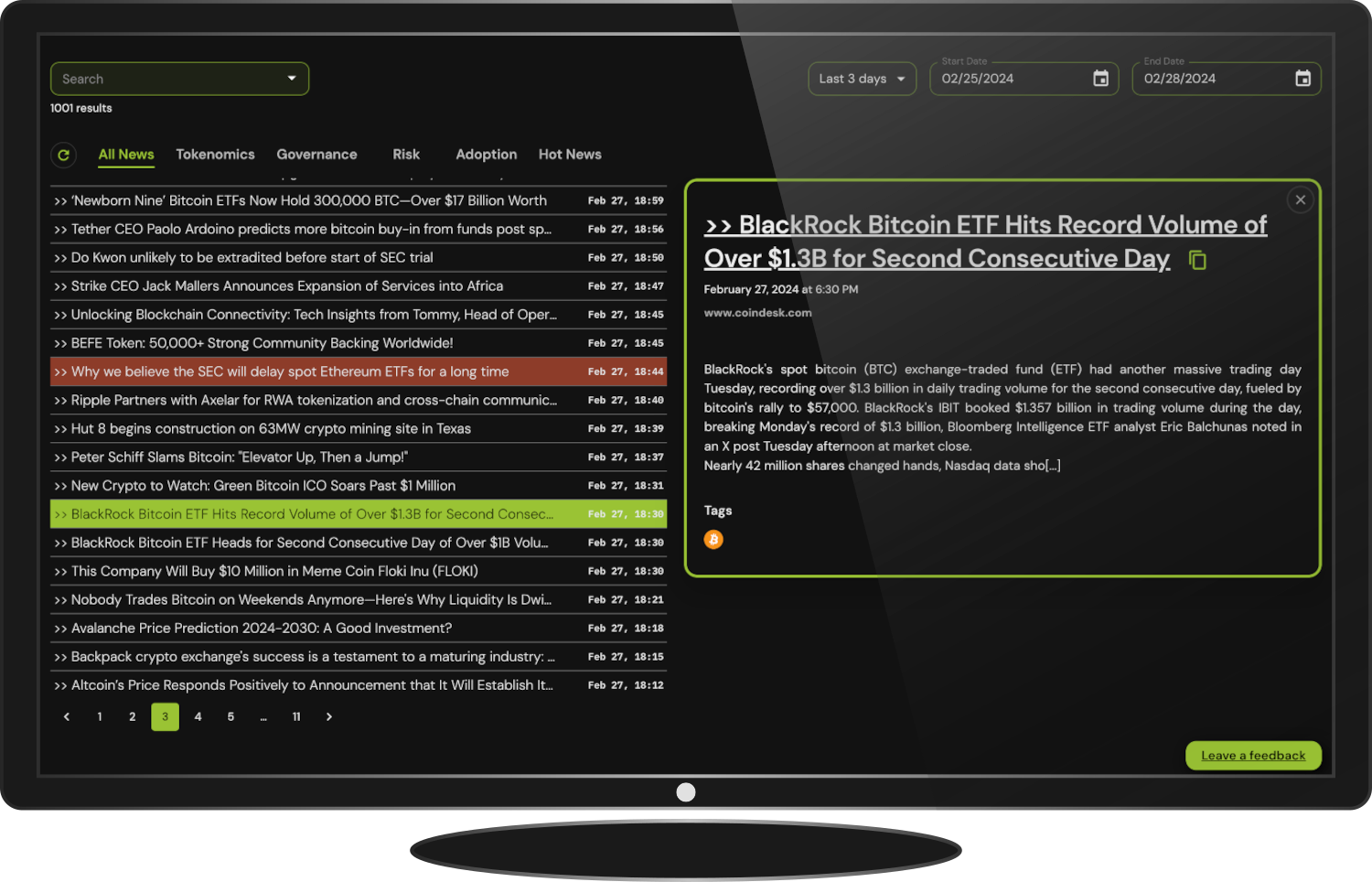

Stay informed and up-to-date on the market's latest news with ARIA's Institutional Terminal's News Aggregator.

Find your curated news articles and analysis from over 50 sources, including the crypto's biggest publications.

Get Institutional Access