by aria-ratings.com

October 18, 2025 at 16:54

SEC Faces Pressure from Ondo Finance on Nasdaq's Tokenization Initiative

Ondo Finance is calling on the U.S. Securities and Exchange Commission (SEC) to delay Nasdaq's proposal for trading tokenized securities.

The company expressed concerns about the lack of transparency regarding how transactions will be settled and the potential for unfair market access.

Nasdaq intends to amend its rules to facilitate tokenized asset trading, seeking reliance on the Depository Trust Company (DTC) for post-trade settlements.

However, Ondo pointed out that there are no solid details or records supporting DTC's process for these tokenized securities.

The firm emphasized that without clear information, the SEC cannot adequately assess whether this plan aligns with the Securities Exchange Act of 1934.

Ondo Finance, which offers various tokenized financial products, warned that limited information favors larger, established firms at the expense of smaller competitors.

They are advocating for transparency, stating that they would support Nasdaq's initiative only if DTC provides a public outline of its settlement process.

Until such information is available, Ondo has requested a formal review from the SEC that could lead to disallowing the proposal.

If approved, Nasdaq's plan would revolutionize how stocks are traded by introducing tokenization to a regulated environment.

However, Ondo’s plea highlights the ongoing tension between innovation and equitable access within the rapidly evolving cryptocurrency landscape.

BlackRock, a leading asset management firm with over $10 trillion in assets, is launching a new fund to meet the rising demand for stablecoin reserves. The initiative aligns with the recently passed GENIUS Act...

Japan's Financial Services Agency (FSA) is set to implement groundbreaking regulations that will permit banks to hold and invest in cryptocurrencies, including Bitcoin. This major policy shift marks a departur...

As China continues to explore digital currencies, Hong Kong is positioning itself as a pivotal player in the stablecoin landscape. With the launch of its regulatory framework, Hong Kong aims to attract stable...

Three of Japan's largest banking institutions—Mitsubishi UFJ Financial Group (MUFG), Sumitomo Mitsui Financial Group (SMFG), and Mizuho Financial Group—are collaborating to introduce a yen-pegged stablecoin. T...

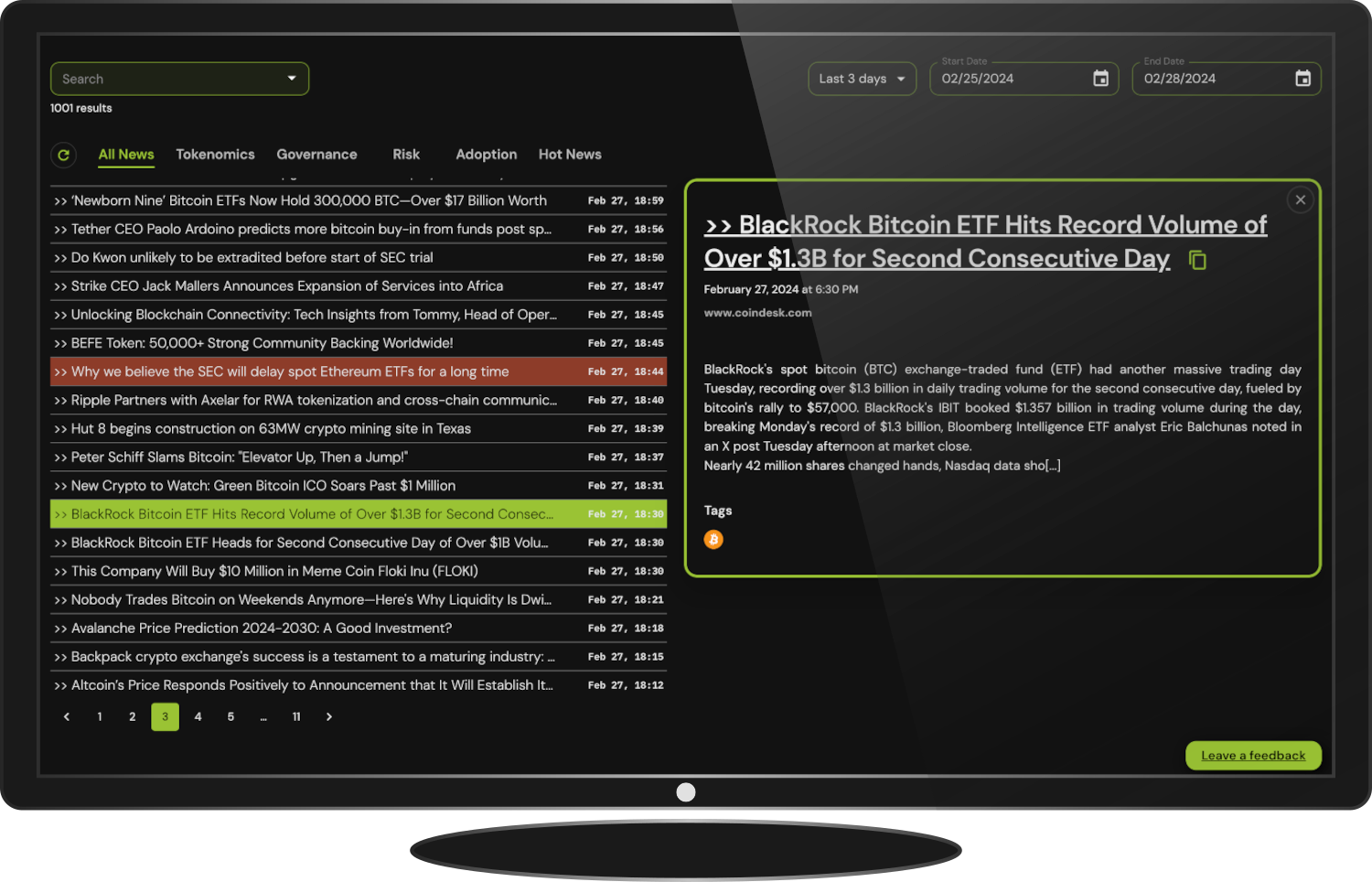

Stay informed and up-to-date on the market's latest news with ARIA's Institutional Terminal's News Aggregator.

Find your curated news articles and analysis from over 50 sources, including the crypto's biggest publications.

Get Institutional Access