by aria-ratings.com

October 18, 2025 at 21:47

Japan's Major Banks Set to Launch Yen-Pegged Stablecoin for Corporate Settlements

Three of Japan's largest banking institutions—Mitsubishi UFJ Financial Group (MUFG), Sumitomo Mitsui Financial Group (SMFG), and Mizuho Financial Group—are collaborating to introduce a yen-pegged stablecoin.

This initiative aims to simplify corporate fund settlements and create a standardized framework for stablecoin utilization across the country.

With a combined client base of over 300,000 corporations, the banks seek to reduce transaction fees and enhance interoperability among their networks.

The stablecoin will be developed on MUFG’s Progmat platform, which supports various blockchains including Ethereum and Polygon.

Initial testing is set to begin soon, with a full launch expected by March 2026, though some sources suggest a potential rollout by late 2025.

Mitsubishi Corporation will be the first to adopt the stablecoin for internal transactions among its extensive network of subsidiaries.

This venture illustrates Japan's shift from cautious regulation to active engagement in the digital finance arena.

Earlier regulatory approvals for stablecoin issuance in Japan demonstrate the government's commitment to fostering a robust digital asset ecosystem.

If the yen-backed stablecoin succeeds, it could lead to a U.S. dollar-pegged version and transform cross-border payment dynamics in Asia.

As Japan's interest in digital currencies grows, the collaboration between these banking titans signifies a pivotal moment in the evolution of the country's financial landscape.

No articles to show at the moment

BlackRock, a leading asset management firm with over $10 trillion in assets, is launching a new fund to meet the rising demand for stablecoin reserves. The initiative aligns with the recently passed GENIUS Act...

Japan's Financial Services Agency (FSA) is set to implement groundbreaking regulations that will permit banks to hold and invest in cryptocurrencies, including Bitcoin. This major policy shift marks a departur...

As China continues to explore digital currencies, Hong Kong is positioning itself as a pivotal player in the stablecoin landscape. With the launch of its regulatory framework, Hong Kong aims to attract stable...

Ondo Finance is calling on the U.S. Securities and Exchange Commission (SEC) to delay Nasdaq's proposal for trading tokenized securities. The company expressed concerns about the lack of transparency regarding...

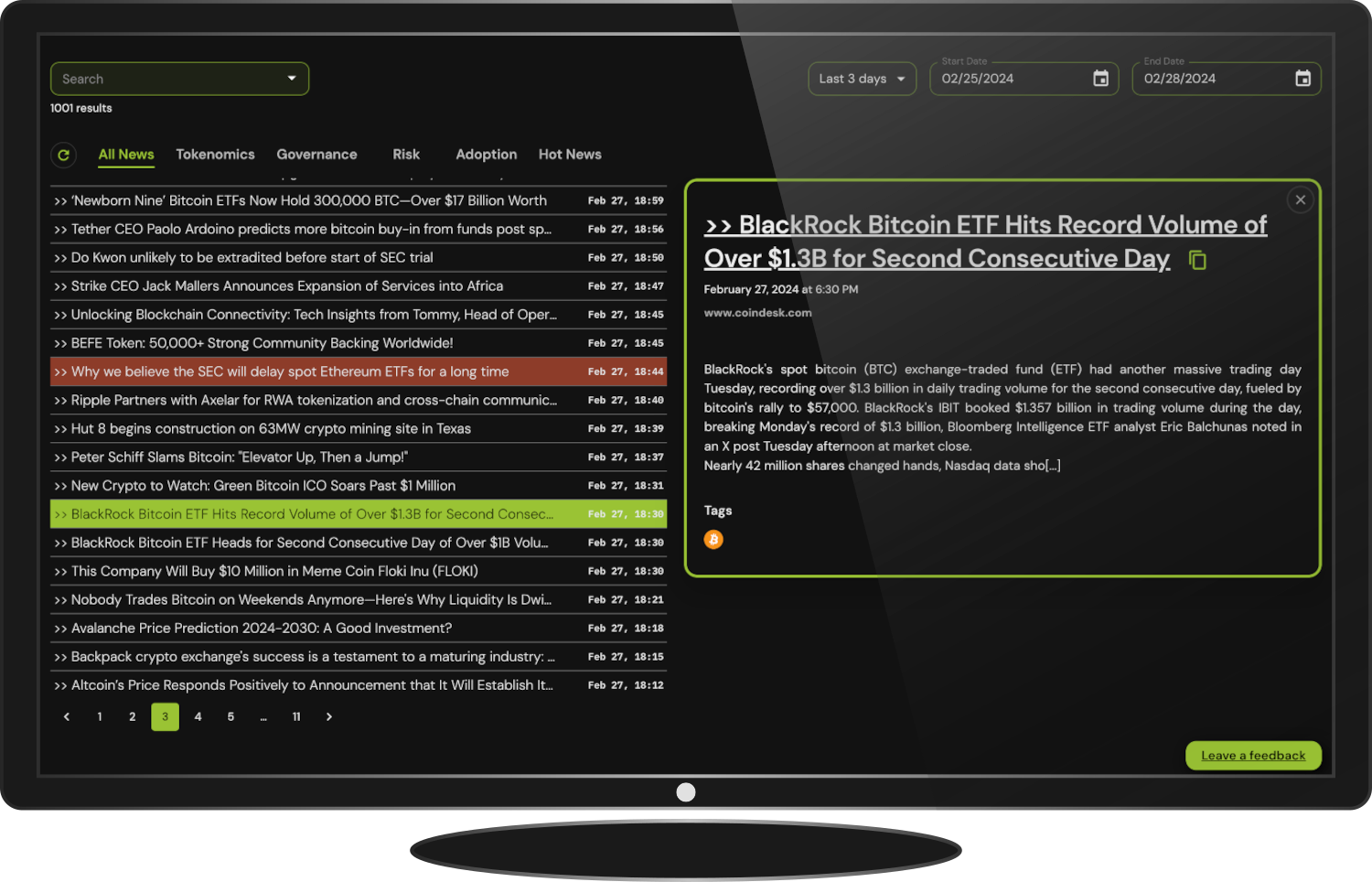

Stay informed and up-to-date on the market's latest news with ARIA's Institutional Terminal's News Aggregator.

Find your curated news articles and analysis from over 50 sources, including the crypto's biggest publications.

Get Institutional Access