As investor demand for structured crypto exposure grows, index providers must evolve beyond simplistic market-cap models. The new standard demands methodological transparency, risk-aware construction, and compliance-aligned governance.

But building and maintaining indices that meet institutional expectations takes more than good intentions—it takes the right infrastructure.

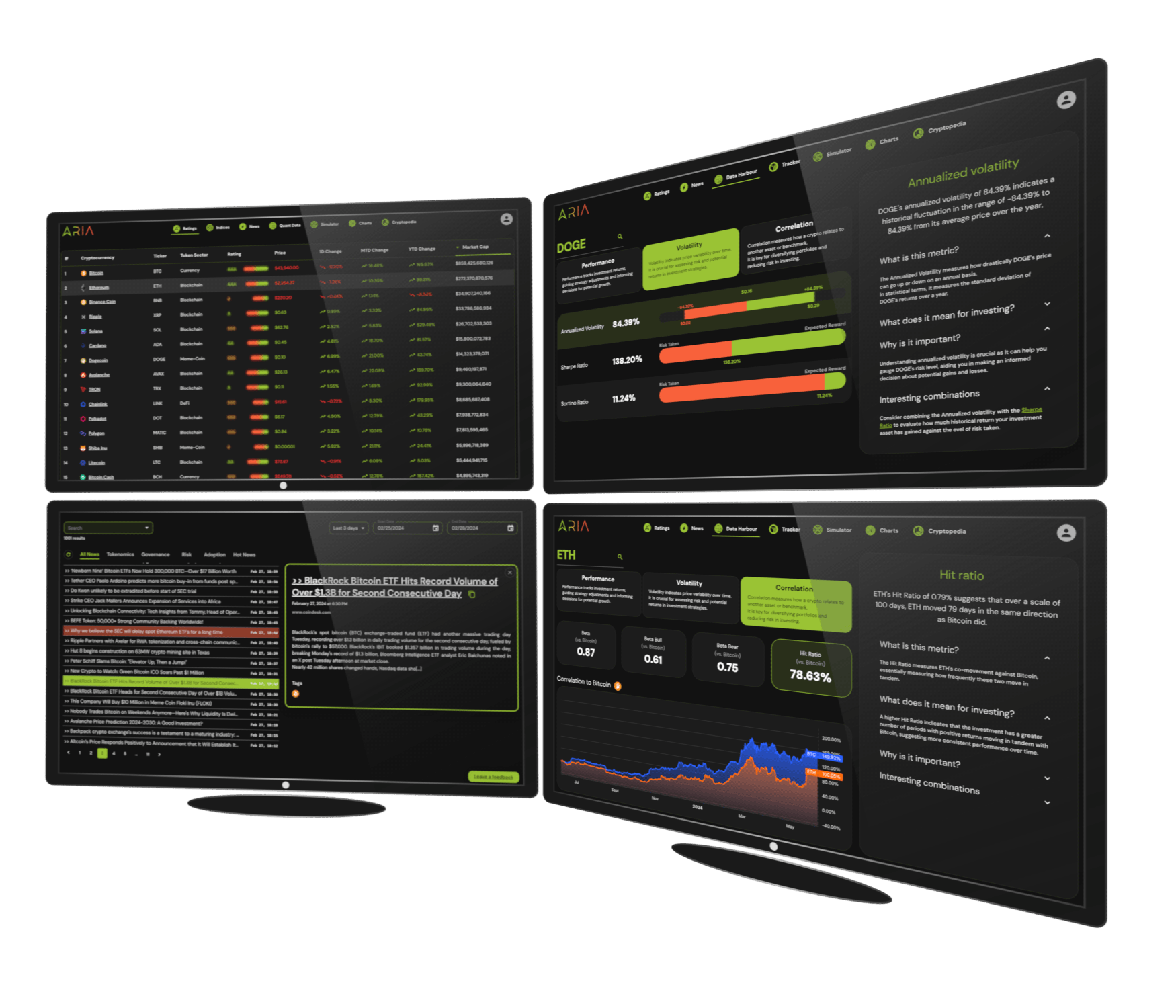

ARIA delivers the logic, data, and operational muscle to help index providers launch smarter, safer, and more scalable benchmarks.

Use ARIA's quantitative risk scores and eligibility datasets to power your own index models or enhance existing offerings.

Partner with ARIA to design, engineer, and maintain passive or thematic crypto indices—ready for product structuring or licensing.

Ensure your indices meet the transparency, governance, and regulatory standards expected by ETF issuers, asset managers, and exchanges.

Access ARIA's proprietary risk scores, whitelisting filters, and classification metrics to define and screen asset universes.

Co-create new indices with ARIA's index team—tailored for themes, asset classes, or mandates. Includes full methodology documentation.

Let ARIA handle daily index calculation, rebalancing, and publication with transparent, auditable workflows.

Integrate ARIA's risk intelligence into your platforms or products via API, FTP, or dashboard feeds.