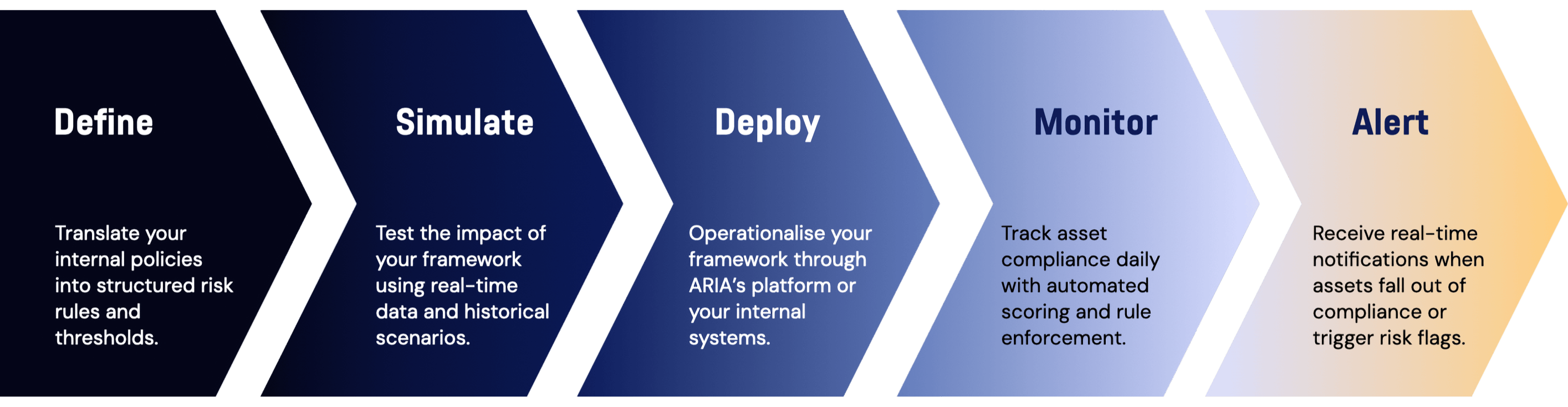

Institutions need structured, defensible processes for managing their exposure to digital assets. ARIA provides an end-to-end solution to help clients design, implement, and manage risk-based whitelisting frameworks—grounded in our proprietary datasets, risk ratings, and methodology expertise.

We act as a third-party risk intelligence partner, powering-up internal policies and enhancing them into automated, actionable frameworks to guide ongoing asset monitoring, as well as listing and de-listing processes.

Automate listing/delisting decisions

Communicate asset governance standards

Maintain credibility with institutional clients

Build sandbox or supervisory frameworks

Enable structured oversight of digital assets

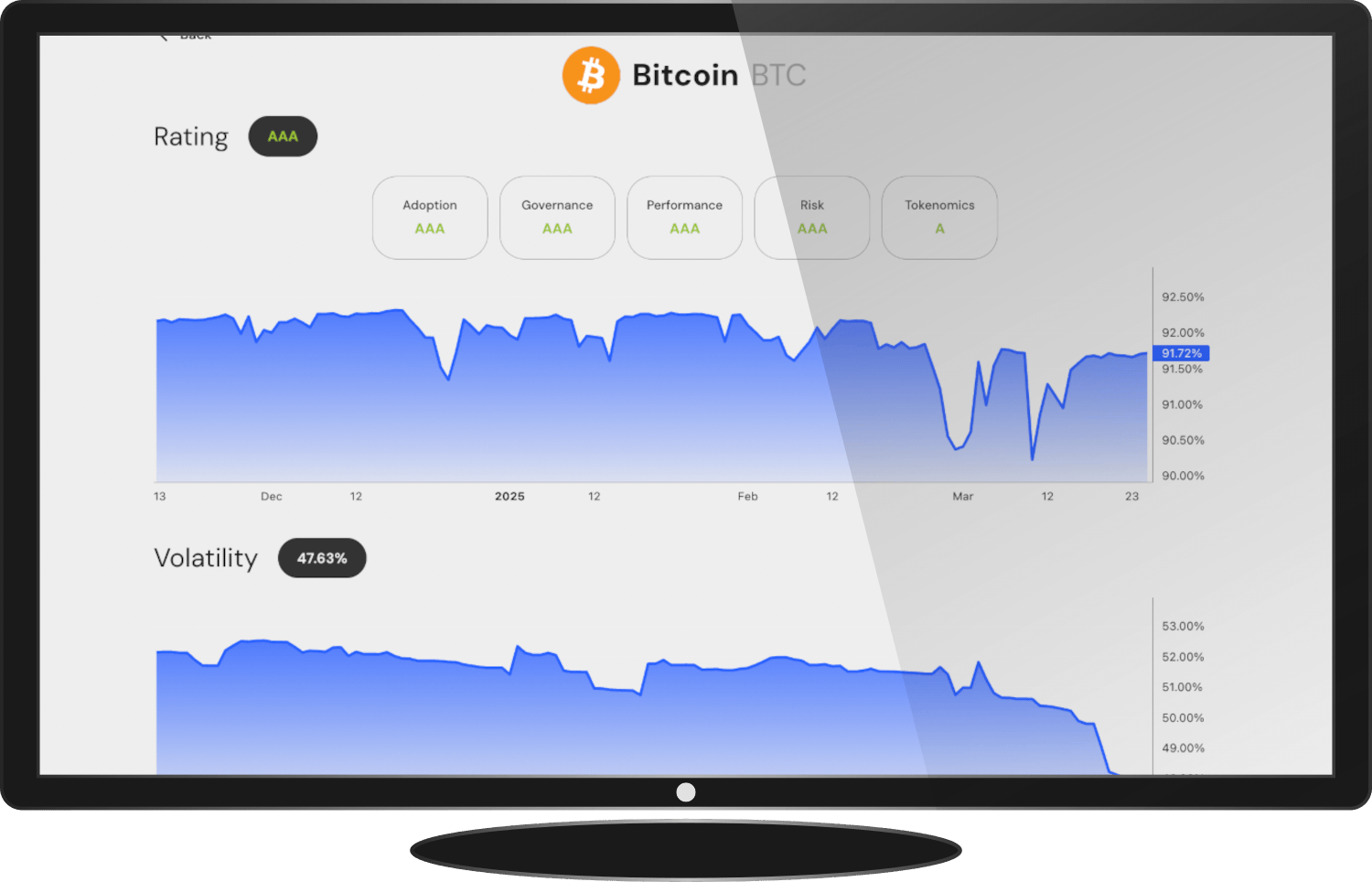

Monitor asset compliance in real time

Define eligible assets for custody or investment

Enforce internal compliance thresholds

Manage reputational and legal risk

Without clear rules, token selection becomes subjective, high-risk, and impossible to justify under scrutiny. ARIA enables you to move from manual judgment to structured oversight—with a solution that is independent, transparent, and aligned to your institution’s objectives.

In crypto, most firms chase performance. Institutions protect reputations. ARIA exists to bring discipline, transparency, and real-time oversight into your digital asset operations. Whether you’re an exchange, regulator, or ETF issuer—we help you turn policy into process, and process into protection.

Yes—we start by listening to your internal goals and then build a framework that reflects those rules using ARIA's risk metrics and datasets.

Our system will flag it immediately, trigger an alert, and (if enabled) provide suggested next steps for your team—ranging from review to delisting.

It can be. We offer both dashboard-based tools for human oversight and API integrations for automated implementation.

Yes—clients can specify any risk or compliance parameters, and we'll help you source, validate, and structure them using our data models.

Daily by default, with intraday triggers for critical events (e.g. delisting by a major venue, spike in volatility).

Yes. Our frameworks are designed to be transparent, version-controlled, and regulatory-aligned for use in compliance documents or sandbox programs.