by aria-ratings.com

June 14, 2025 at 18:33

SEC Faces New Challenge as Seven Solana ETF Filings Flood In

On June 13, seven issuers filed or amended applications for spot Solana exchange-traded funds (ETFs) with the U.S. Securities and Exchange Commission (SEC), showcasing a growing institutional interest in Solana.

Despite this surge in filings, experts warn that approval from the SEC is not a certainty, drawing parallels to the protracted journey of Bitcoin ETF approvals in the past.

Key players like Fidelity and Grayscale have included staking provisions in their ETF applications, which may complicate the regulatory approval process.

Analysts at Bloomberg have suggested that the SEC could be evolving in its approach to staking, potentially allowing it as part of ETF offerings.

Recent sentiment in the market indicates a 90% chance of Solana ETFs receiving approval by 2025, reflecting optimism among crypto industry insiders.

The integration of staking mechanisms highlights a shift towards ETFs that could generate income for investors, thus differentiating them from more conventional investment products.

As regulatory frameworks adapt, these Solana ETF filings might pose a challenge to the established dominance of Ethereum in the altcoin market.

The developments contribute to a broader trend towards embracing digital assets in mainstream finance, which could stimulate increased investor interest.

If approved, these ETFs could mark a significant step towards regulated cryptocurrency investments in the U.S., creating new opportunities for investors.

In conclusion, although uncertainties persist, the momentum from these filings illustrates the ongoing interplay between innovation and regulatory frameworks in the cryptocurrency landscape.

In a recent interview, former Goldman Sachs executive Michael Bucella shared insights on the current Bitcoin market dynamics. Despite significant demand from companies looking to add Bitcoin to their balance s...

Germany's Deutsche Bank is gearing up to introduce its own crypto custody service, slated for launch in 2026. This initiative seeks to provide clients with a secure platform to store popular cryptocurrencies l...

United Kingdom-based web design and marketing firm The Smarter Web Company has made headlines by adding $24.7 million worth of Bitcoin to its treasury. The firm purchased an additional 230.05 BTC at an average...

Robinhood is making waves in the financial landscape by launching US stock and ETF tokens in Europe, a significant blending of traditional equities and blockchain technology. This strategic move aims to simpli...

Recent system upgrades by American Express have ignited speculation about a potential integration of Ripple's blockchain technology into its operations. Clients have been experiencing delays in cross-border pa...

Circle, the issuer of USDC, is planning to establish a national trust bank in the United States following its $18 billion Initial Public Offering (IPO). The proposed entity, named First National Digital Curren...

The Bank of Korea (BOK) has suspended its Central Bank Digital Currency (CBDC) project amid a growing emphasis on stablecoin regulation by South Korean lawmakers. This halt impacts the Han River Project, affec...

Connecticut has officially enacted a significant new law banning state entities from engaging with Bitcoin and other cryptocurrencies. Governor Ned Lamont's signing of House Bill 7082 establishes the "Bitcoin ...

Japan-based online gaming company CyberStep is making headlines by announcing its entry into the cryptocurrency investment sector effective July 1, 2025. The firm, known for its popular crane game "Toreba," ha...

Circle Internet Group has officially applied for a national trust bank charter to enhance its operations involving the USDC stablecoin. This move, disclosed by Reuters, aims to solidify Circle’s position withi...

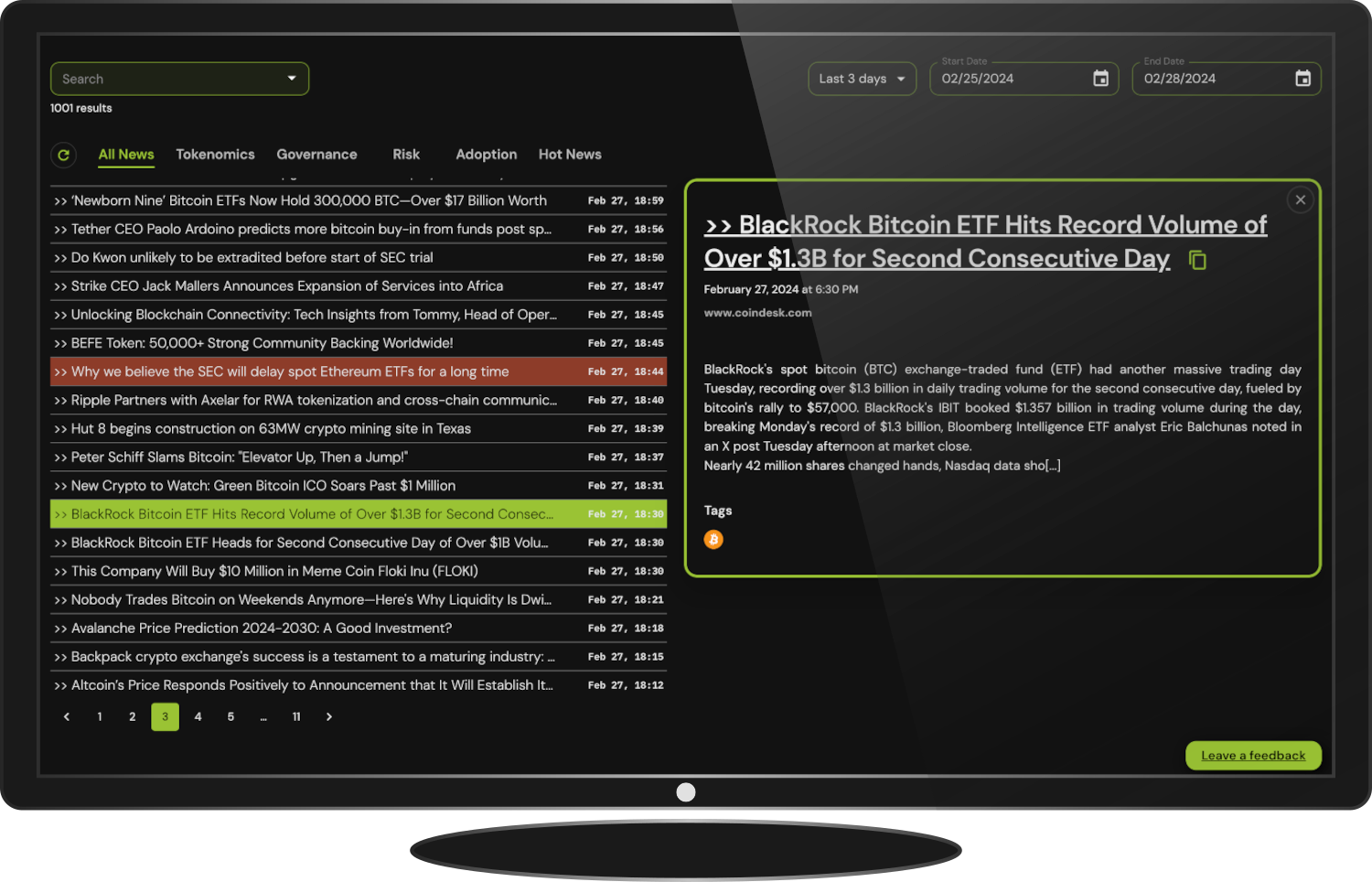

Stay informed and up-to-date on the market's latest news with ARIA's Institutional Terminal's News Aggregator.

Find your curated news articles and analysis from over 50 sources, including the crypto's biggest publications.

Get Institutional Access