by aria-ratings.com

July 9, 2025 at 19:37

SEC's Move on Ethereum Could Open Doors for BlackRock's Bitcoin ETF

The U.S. Securities and Exchange Commission (SEC) is reportedly reconsidering its stance on Ethereum, which could influence the future approval of Bitcoin exchange-traded funds (ETFs).

BlackRock, a major player in asset management, has keen interest in launching a Bitcoin ETF that could lead the way for institutional investment.

The SEC's examination of Ethereum's classification could set a precedent for how cryptocurrencies are regulated moving forward.

If Ethereum is classified more favorably, it may ease regulatory concerns surrounding other digital assets, including Bitcoin.

This shift could positively impact BlackRock's efforts, potentially expediting the approval process for its Bitcoin ETF application.

Institutional investors are watching these regulatory developments closely as they seek clarity in a sometimes confusing market.

The outcome will also play a pivotal role in determining market trends and investor confidence in cryptocurrencies.

Overall, the SEC's decisions could reshape the landscape of crypto investment, particularly for large institutional firms.

Following these events, analysts believe that we could see a significant influx of capital into the cryptocurrency space.

As always, investors should remain cautious and informed as these changes unfold.

Ant Group, the fintech giant founded by Jack Ma, is set to integrate Circle's USDC stablecoin into its blockchain platform. This partnership comes as Ant Group seeks to enhance its global presence in the digit...

Ripple CEO Brad Garlinghouse recently celebrated a significant legal victory against the SEC, affirming that XRP is not a security. The lawsuit, which began four years ago, has underscored the challenges exist...

In an impressive display of demand, Snoop Dogg’s recent NFT launch on Telegram completely sold out in just 30 minutes. This monumental event highlights the growing trend of integrating NFTs with social media p...

British fintech company Revolut has temporarily frozen all cryptocurrency services in Hungary following a government decree that prohibits crypto transactions. This sudden suspension, announced on July 7, has ...

US Securities and Exchange Commission (SEC) Commissioner Hester Peirce has issued a critical warning regarding the legal status of tokenized stocks within the crypto sector. As interest grows in tokenized secu...

The United Kingdom is poised to implement significant cryptocurrency regulations aimed at ensuring consumer protection and market stability. As the crypto market in the UK is projected to reach $1.6 billion, t...

In a recent Senate hearing, Chairperson Tim Scott emphasized the urgent need for a well-defined crypto market structure in the U.S. Scott highlighted the importance of the GENIUS Act and stated that digital ass...

Ripple CEO Brad Garlinghouse recently appeared before a U.S. Senate hearing to discuss the future of crypto regulations. During the hearing, he emphasized the importance of establishing clear and fair rules fo...

Recent geopolitical tensions have shifted focus onto the U.S. dollar and its role in global finance, with accusations aimed at the Biden administration for its handling of sanctions. Russian officials assert t...

USDT prices have surged in Argentina, reflecting a notable spike in demand for US dollars in the country. On July 8, the price of USDT exceeded 1,280 pesos, translating to approximately USD 1.02, marking a dev...

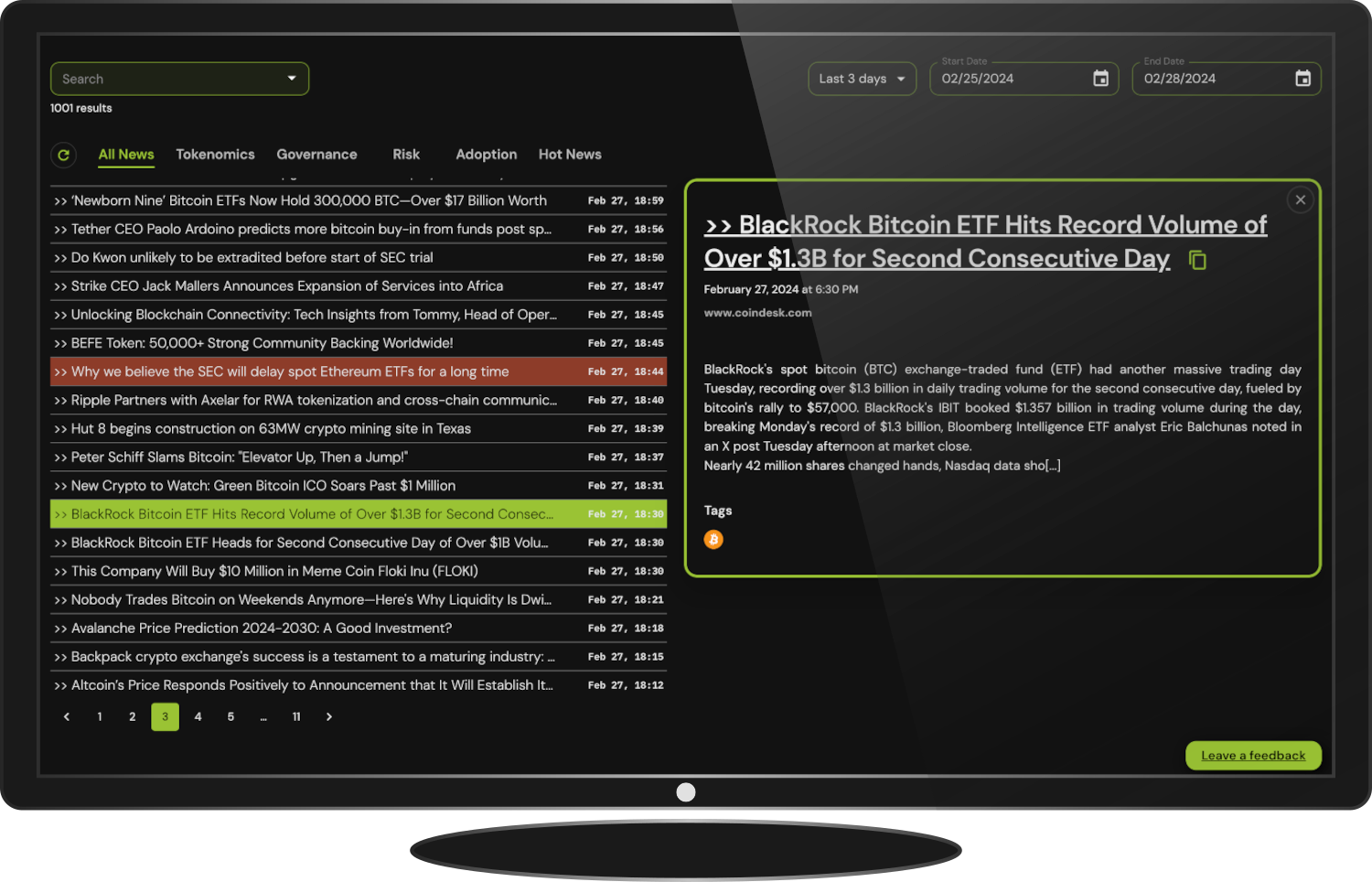

Stay informed and up-to-date on the market's latest news with ARIA's Institutional Terminal's News Aggregator.

Find your curated news articles and analysis from over 50 sources, including the crypto's biggest publications.

Get Institutional Access