by aria-ratings.com

August 2, 2025 at 05:11

UK FCA Eases Retail Access to Crypto ETNs: A New Era for Investors

The Financial Conduct Authority (FCA) in the United Kingdom has announced significant changes regarding retail access to crypto exchange-traded notes (ETNs) effective October 8.

This regulatory shift ends a four-year ban, acknowledging the evolving understanding among consumers and maturity of the market.

Retail investors will be able to trade these ETNs on FCA-recognized investment exchanges, ensuring adherence to strict financial promotion rules aimed at protecting consumers.

While this move aligns the UK with countries like the US and Canada, it's worth noting that investor protections such as the Financial Services Compensation Scheme will not apply to these products.

FCA official David Geale highlighted the importance of consumers being aware of risks involved, emphasizing that firms must deliver fair outcomes under the Consumer Duty framework.

Despite this advance, the FCA continues its ban on more volatile crypto derivatives like futures, emphasizing ongoing consumer protection.

Industry experts have welcomed this decision as a step towards aligning UK regulations with international standards, promoting a more transparent investment landscape.

The move is poised to enhance investor confidence, providing more choices while ensuring that the inherent risks of cryptocurrency are clearly communicated.

As the market continues to evolve, the FCA aims to establish a balanced regulatory framework that nurtures growth while safeguarding consumer interests.

This could pave the way for more innovative financial products in the crypto space, marking an exciting chapter for retail investors in the UK.

No articles to show at the moment

The U.S. Securities and Exchange Commission (SEC) has announced a groundbreaking initiative called Project Crypto to reshape digital asset regulation. Led by Chairman Paul S. Atkins, this project aims to simpl...

In a bold move, Coinbase has taken legal action against the Federal Deposit Insurance Corporation (FDIC) to uncover details about alleged “pause letters” that discourage banks from engaging with crypto services...

Solana (SOL) is garnering significant interest from institutional investors as major asset managers like Franklin Templeton and Fidelity revise their ETF applications with the SEC. This renewed attention has p...

The ongoing saga between the SEC and Ripple is approaching a crucial juncture in early 2025. Although Ripple has fulfilled its obligations, including a $125 million penalty and withdrawing its cross-appeal, th...

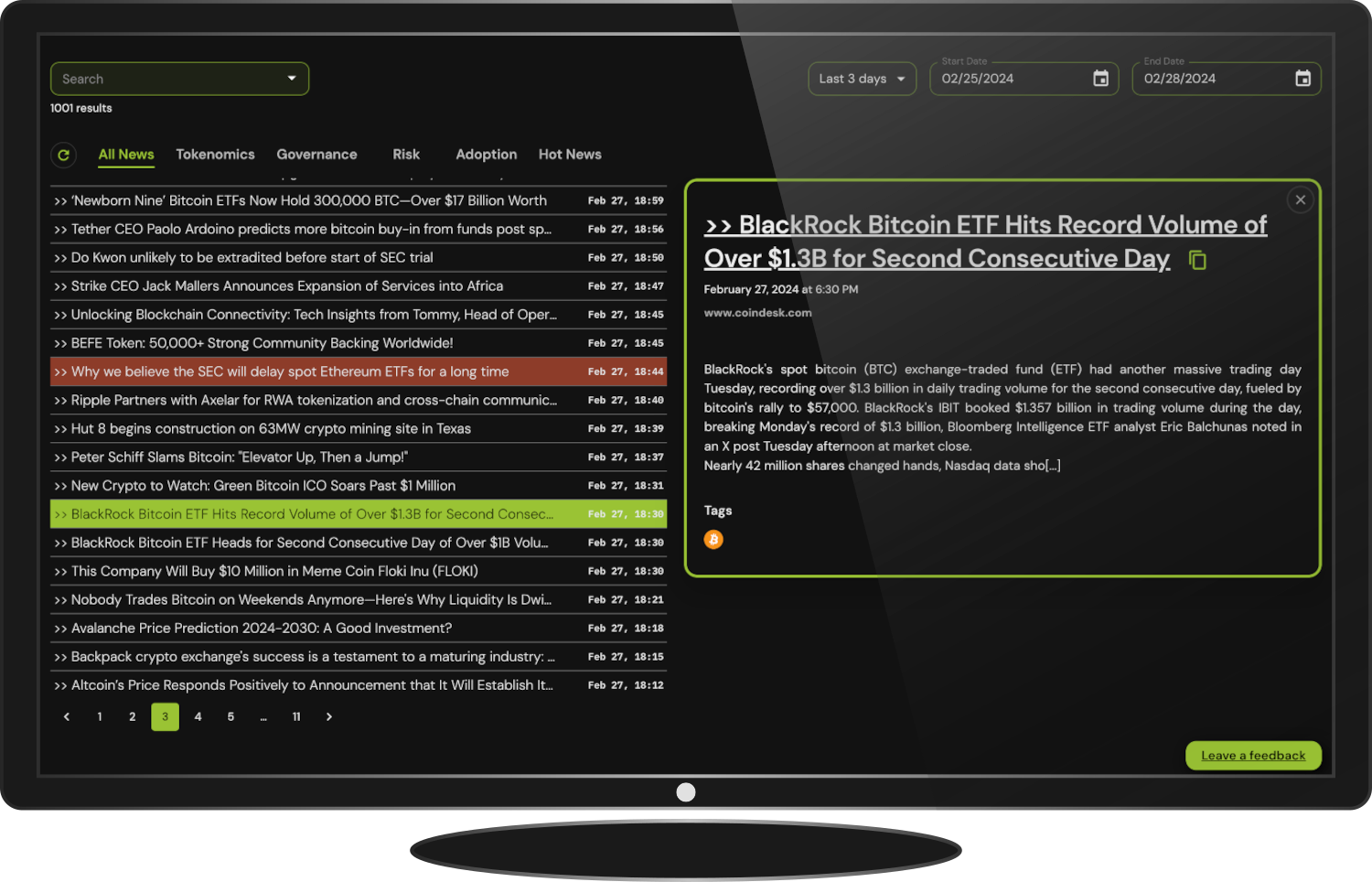

Stay informed and up-to-date on the market's latest news with ARIA's Institutional Terminal's News Aggregator.

Find your curated news articles and analysis from over 50 sources, including the crypto's biggest publications.

Get Institutional Access