by aria-ratings.com

August 16, 2025 at 15:16

Grayscale's Ambitious Move: Dogecoin ETF Under Ticker GDOG Could Change the Game

Grayscale has officially filed for a spot Dogecoin exchange-traded fund (ETF) with the U.S. Securities and Exchange Commission (SEC).

If approved, this ETF would give investors a regulated avenue to gain direct exposure to Dogecoin, one of the most popular meme coins.

The proposed fund plans to trade under the ticker symbol GDOG on NYSE Arca, allowing for better liquidity and easier access for traditional investors.

Grayscale's move can be seen as a significant push towards mainstream acceptance of cryptocurrencies, particularly in the U.S. financial landscape.

The firm’s Dogecoin Trust, which currently holds approximately $2.5 million in assets, will be transformed into this ETF format.

Other competitors are also vying for a slice of the Dogecoin ETF market, including firms like Bitwise and Rex-Osprey.

Market sentiment is notably optimistic, with projections suggesting a 75% likelihood that the SEC will grant approval for the ETF by the end of 2025.

Following the filing, Dogecoin's price saw a significant increase, signaling strong market interest in the potential ETF.

However, regulatory challenges still loom, as the SEC's cautious approach toward approving cryptocurrency ETFs remains a critical factor.

In summary, if the GDOG ETF is successfully launched, it could significantly enhance the institutional and retail integration of Dogecoin into traditional finance.

Gemini, the crypto exchange created by the Winklevoss twins, is preparing for a public debut on Nasdaq despite facing significant losses. The exchange recently filed its S-1 registration with the SEC and aims ...

Recent developments in the Solana (SOL) market have sparked both concern and optimism among analysts. Following a brief surge fueled by Bitcoin and Ethereum reaching new highs, Solana tumbled below the critica...

The U.S. Federal Reserve has recently announced the termination of its Novel Activities Supervision Program, which was set up to specifically monitor banks' involvement with cryptocurrencies and fintech activit...

The recent sanctions imposed by the U.S. Treasury’s Office of Foreign Assets Control (OFAC) on the ruble-pegged stablecoin A7A5 signify a critical response to Russia’s exploitation of cryptocurrency for financi...

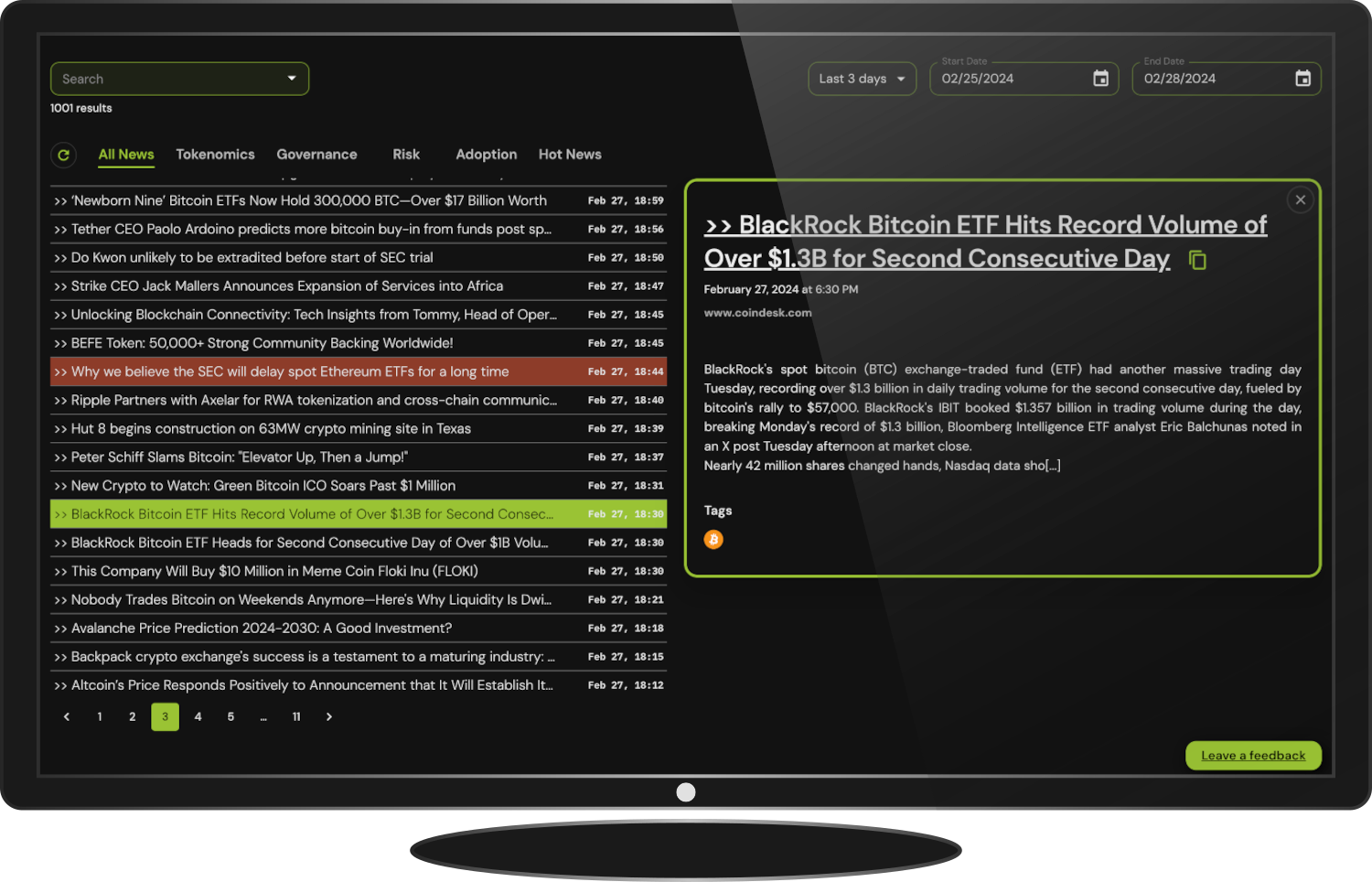

Stay informed and up-to-date on the market's latest news with ARIA's Institutional Terminal's News Aggregator.

Find your curated news articles and analysis from over 50 sources, including the crypto's biggest publications.

Get Institutional Access